The Loonie Hour #76

In this week's episode, energy expert Andrew Haynes joins us to discuss the future of fossil fuels and Canadian oil & gas policy. We also talk about inflation and population growth.

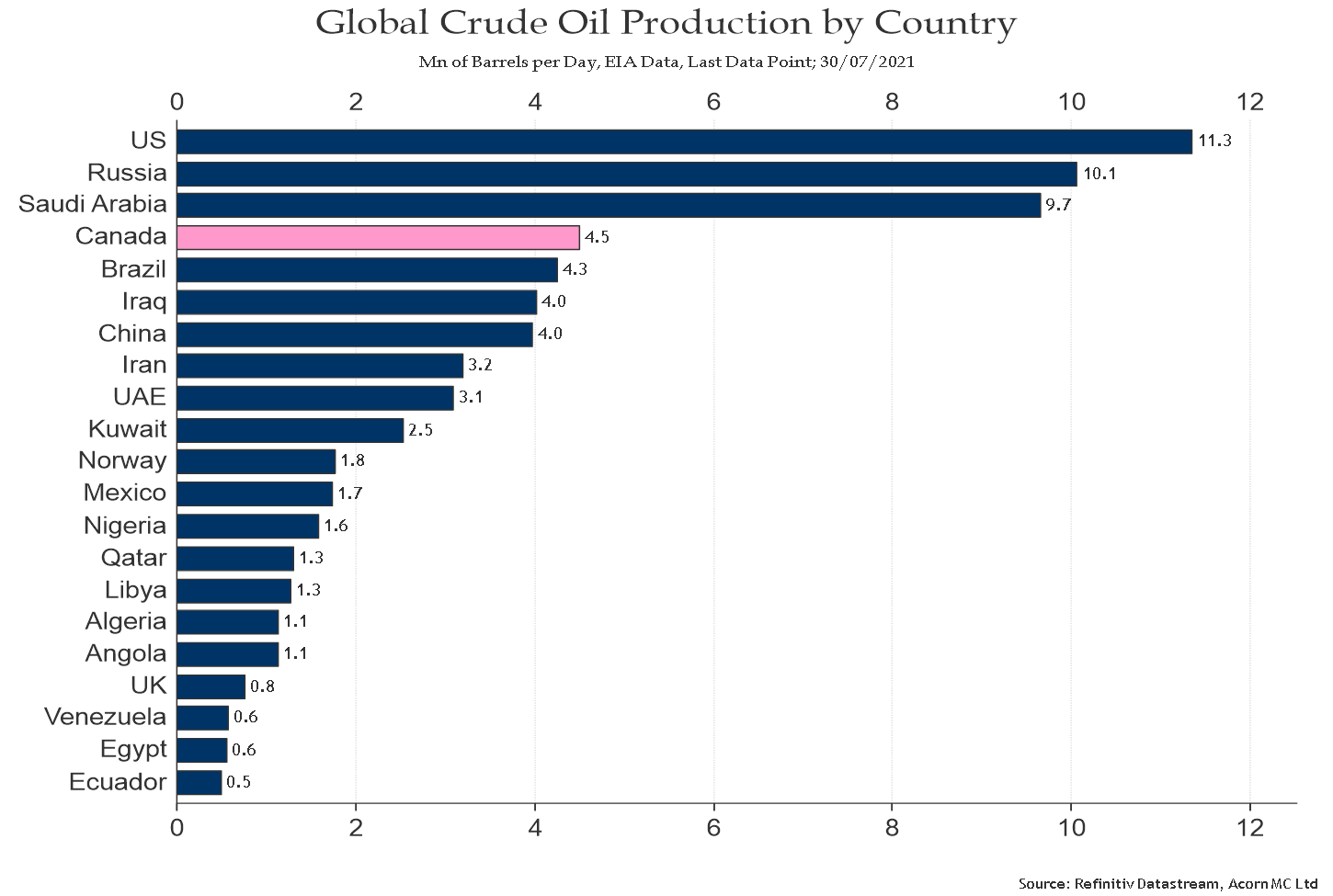

Canada is ideally placed to step in, but it lacks the political will to do what’s right for its allies and the world. It sits on 10% of known oil reserves (3rd most globally), is politically stable, and is geographically well situated. By building more liquified natural gas liquefaction plants and facilitating an increase in refining capacity, Canada could simultaneously help its allies, lower global emissions and reduce its dependence on the US. Sadly, the federal government is hostile to the sector and is adamant that Canada can painlessly shift its economy away from producing and exporting fossil fuels.

Andrew was kind enough to share with us several of the resources he has used to inform his opinions.

Energy Return on Investment; The economics of electricity generation are important. If the financial cost of building and operating the plant cannot profitably be recouped by selling the electricity, it is not economically viable.

LNG Export Capacity Growth; Global LNG demand is forecast to reach 401 million tons this year, a 2% uptick from 2022, while global LNG supply is set to grow 3% to an estimated 415 million tons.

Global Coal Consumption IEA Report; Coal used in electricity generation, the largest consuming sector, is expected to grow by just over 2% in 2022.

Foreign interference in Canadian Energy Sector; Gwyn Morgan - Ex-Encana CEO on Environmental Activists in Canadian Government. Vivian Krause Study.

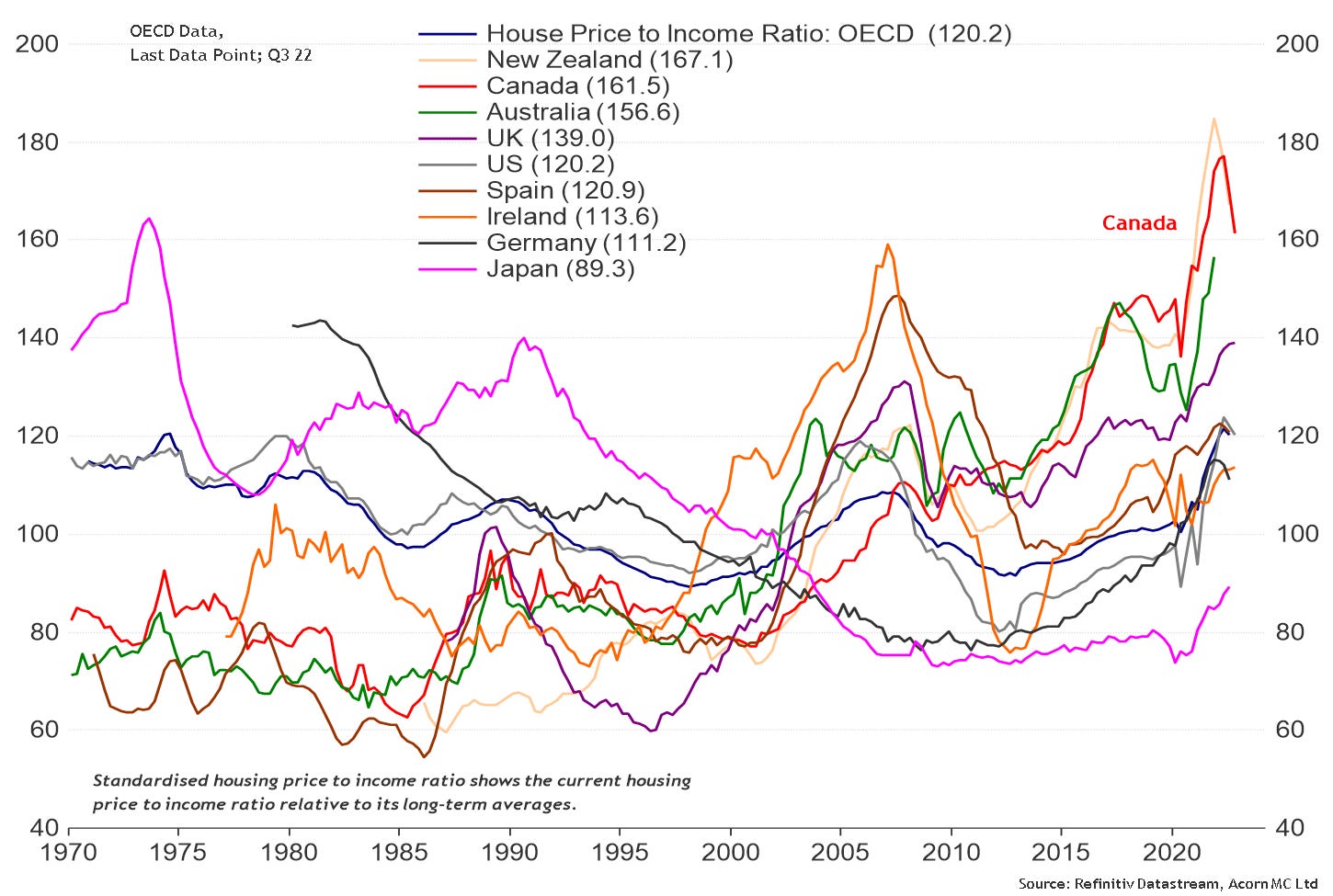

Andrew mentioned a huge change in New Zealand housing policy specifically zoning regulations. New Zealand, like Canada has been in the midst of a housing crisis for more than a decade, driven by multiple factors including restrictive planning law, a lack of housing supply, an unchecked property investor market, and a widening gulf between income and housing costs. You can read more about the new rules and regulation here.

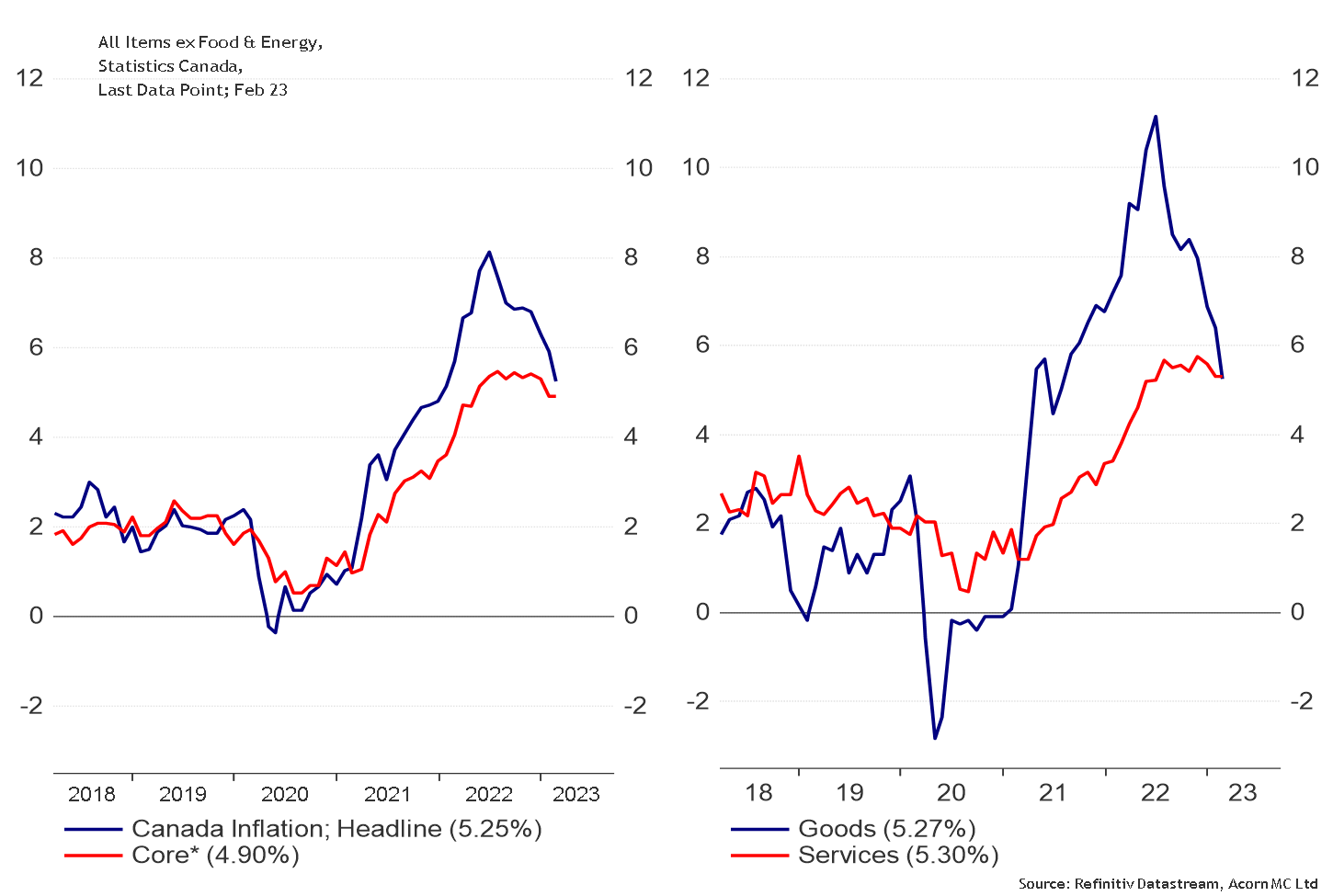

Headline Inflation (CPI) has peaked, and is heading lower. The main consumption basket fell (YoY) to 5.25%. Energy and Transportation continue to act as the main drags on the Headline measure. Food purchased from stores rose 10.6% year over year in February, marking the seventh consecutive month of double-digit increases. Core, excluding Food and Energy, was flat 4.9%. Peak inflation is behind us but remains well above the BOC's inflation-control target of 2% (+/-1%).

The Goods and Services inflation story has not changed. Goods, the more volatile of the two sub-components, continues its precipitous decline as Energy price growth moderates, supply chains normalize and spending shifts back toward Services. Services, the stickier of the two main subcomponents, sits at 30-year highs of 5.3% but looks to have peaked.

Click below to listen to this week’s episode!.