The Loonie Hour #78

In this week's episode, we discuss Canadian employment, global manufacturing weakness, de-dollarization & the impossible trinity.

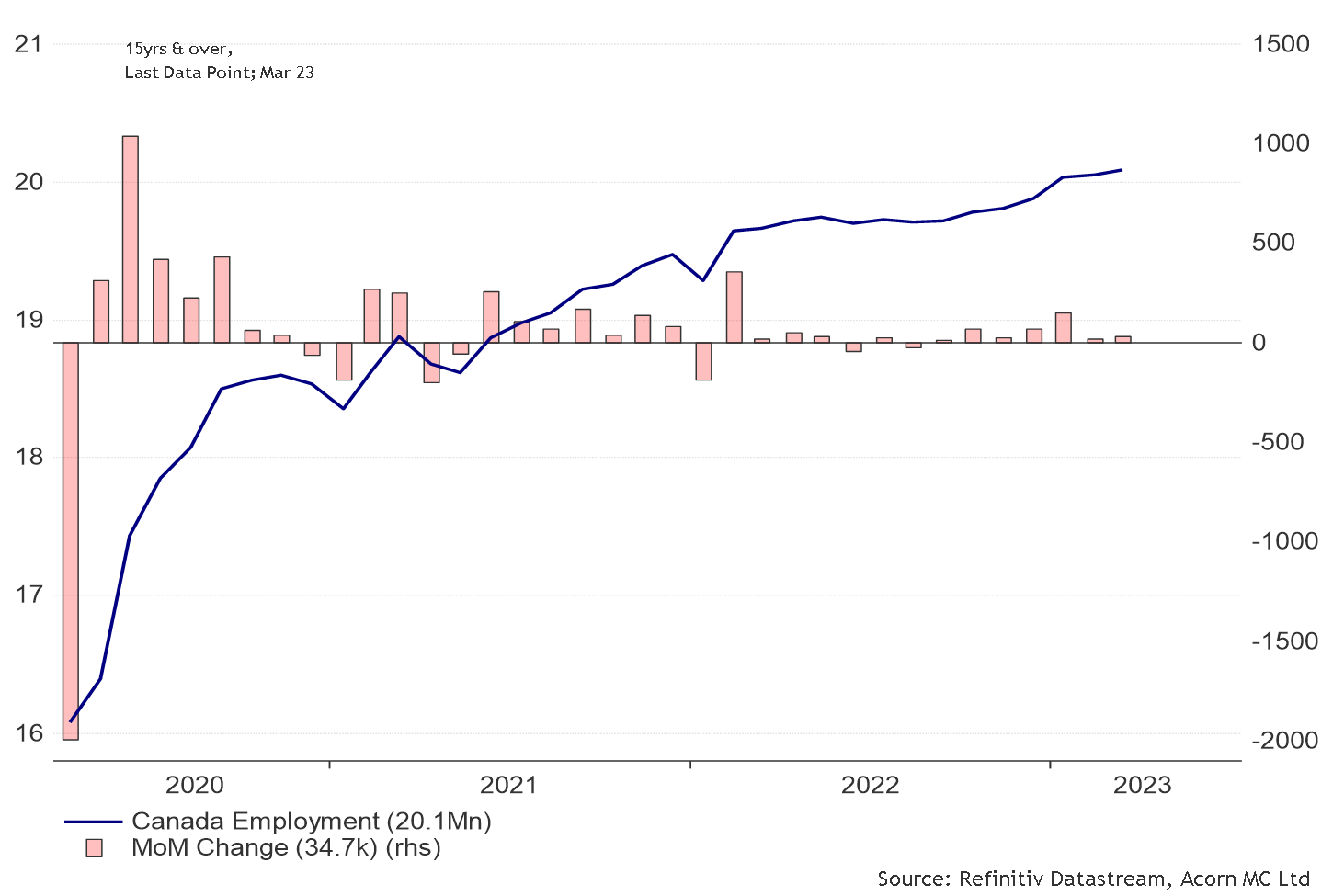

Canadian employment increased by 35k in March (vs 12k exp) following little change in February and strong growth in January (+150k) and December (+69k), pushing the year-on-year (YoY) job growth to nearly half a million. Nearly all of the gains in March were from private sector employees (+35k), while the public sector and self-employment saw little change. Total hours worked rose 0.4%, average hourly wages rose 5.3% (YoY), and for the fourth consecutive month, the unemployment rate was 5.0% in March, just above the record low of 4.9% observed in June and July of 2022. If there is no further moderation of core inflation, continued strong job growth will ratchet the pressure to resume raising rates.

Over the month, there were notable gains in transportation and warehousing, business services, and finance. Employment declined in construction, other services, healthcare and natural resources. However, drawing important conclusions from the Canadian monthly employment release is difficult as it is often subject to material revisions.

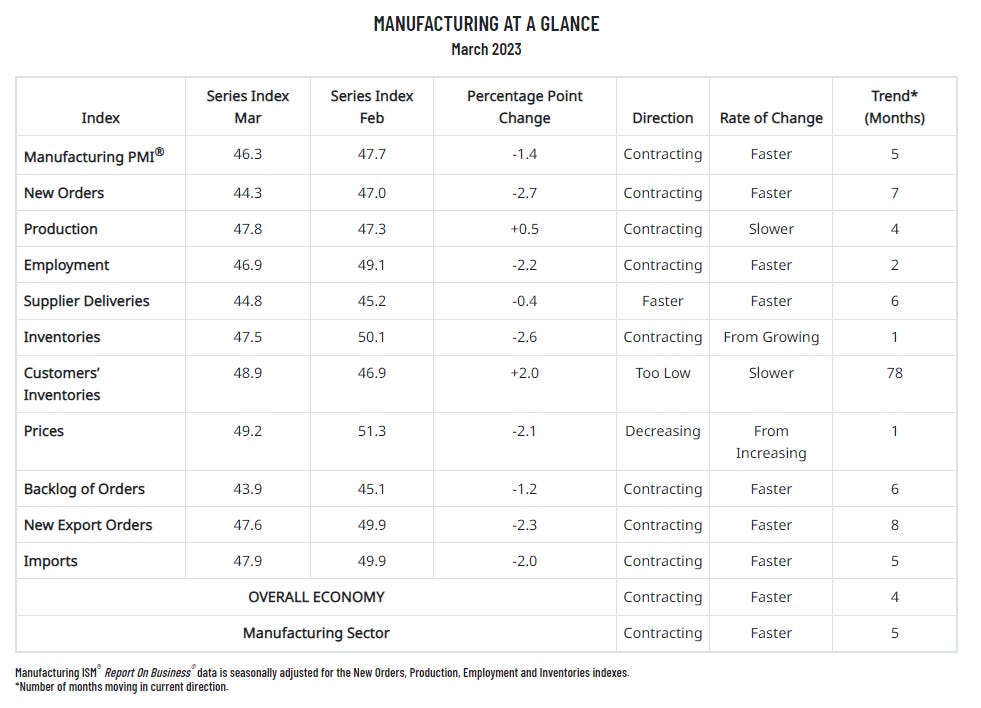

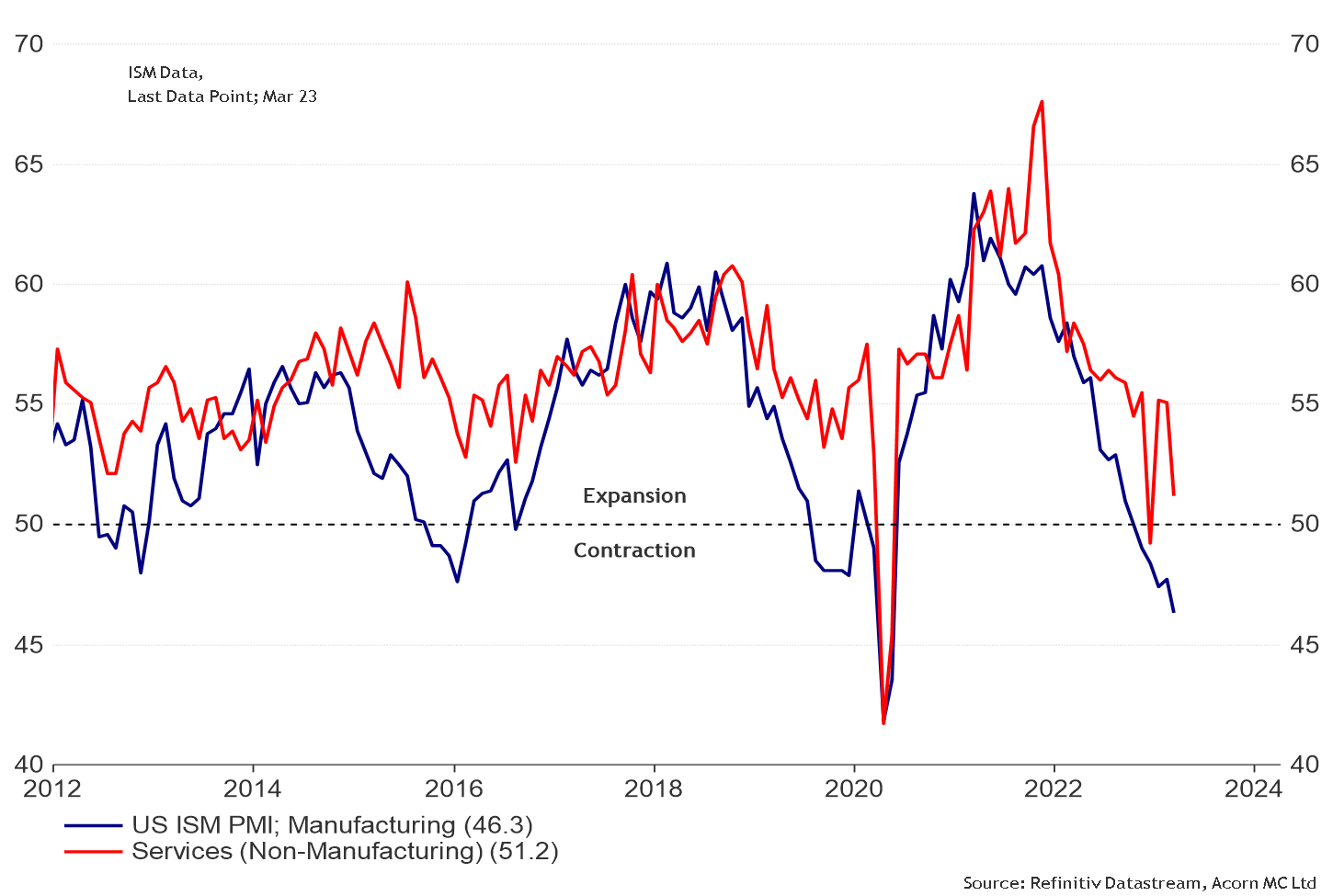

In the US, the ISM Manufacturing PMI released its March figures. As expected, it was more bad news. The US manufacturing sector contracted for a fifth consecutive month, with the index declining by 1.4 to 46.3 (vs 47.5). New orders and new export orders have declined sharply, while the employment index has continued to contract. However, supply chain issues have improved considerably. Worryingly, only two of the six largest manufacturing industries, Petroleum & Coal Products and Machinery, registered growth in March.

The US ISM Non-Manufacturing (Services) PMI fell more than expected to 51.2, badly missing expectations (54.5). Back above 50 - the expansion-contraction line - the services sector expanded for the third consecutive month. Despite a slight decrease in the Business Activity Index, the New Orders Index expanded in March for the third consecutive month, which is a positive sign. The report suggests that the services sector is still recovering from the effects of the pandemic. The comments section of the ISM report is illuminating, and despite the significant drop in the index, most respondents have a positive outlook on business conditions.

A rehash of a tired subject partially dominate the Twittersphere this week; the issue of de-dollarization aka the US loosing is reserve currency status. Well, it’s not going to happen, not any time soon anyway.

A reserve currency is a currency that is widely held by governments, central banks, and other financial institutions as a means to settle international debt obligations or to influence their domestic exchange rates. Foreign exchange reserves (reserves) are typically issued by politically and economically stable countries with strong financial systems and low inflation rates. They moneys are held by a country's central bank or monetary authority. Reserves can take the form of banknotes, special drawing rights (SDRs), bonds, treasury bills, and gold. Foreign exchange reserves are used to balance payments related to trade, meet external debt obligations, and can be used to influence a country's currency (i.e., exchange rate). Ample foreign exchange reserves serve to maintain confidence in an economy's financial markets. Moreover, sound reserve management policy can increase a country's resilience to adverse economic shocks.

In theory, reserves can be held in any currency, but as the chart above highlights, the US Dollar makes up approximately 59% of Allocated Global foreign currency reserves. The euro, and Yen are currencies with the second and third largest reserve holdings. A closer look at the chart also shows that it has not always been clear in what currency the foreign exchange reserves were denominated. These "Unallocated" reserves used to represent 47% of the total (grey bars). However, in 2015, China subscribed to the IMFs Special Data Dissemination Standard (SDDS). Participation in the SDDS meant that China and other large Asian economies were required to start properly recording the currency of their foreign reserves thus shifting the count from "Unallocated" to "Allocated". Naturally, the proportion of Unallocated reserves fell as China slowly reclassified the data and the dominance of the US Dollar revealed itself.

Historically, war and conquest have played a central role in the rise and fall of reserve currencies. Portugal's succession crisis in 1580 marked the end of its struggling empire and the rise of Spain's escudo as a world reserve currency. The Dutch-Portuguese War saw the Dutch florin take over as the world's currency, followed by French monetary dominance and then the rise of the US dollar after World War I. In each case, military conflicts and the monopolistic dominance of trade routes paved the way for the emergence of new reserve currencies.

Finally, we discussed the Impossible Trinity to help explain why China is not a viable option - not without an open capital account. The impossible trinity, also known as the trilemma, is an economic concept that suggests that it is impossible for a country to simultaneously have a fixed foreign exchange rate, free capital movement, and an independent monetary policy. In other words, a country can only achieve two out of these three goals at a time, but cannot achieve all three at once. If a country wants a fixed exchange rate, it must restrict capital flows or give up monetary policy independence. If it wants an independent monetary policy and free capital flows, it must allow the exchange rate to float. The concept is important in understanding the trade-offs and limitations of economic policy choices in a globalized world. Of course, it’s only a theory; who knows what the future will bring?

Click below to listen to this week’s episode!