The Loonie Hour #85

On this week's podcast, we discuss higher mortgage rates hurting household consumption, Germany's recession and the US debt ceiling hysteria.

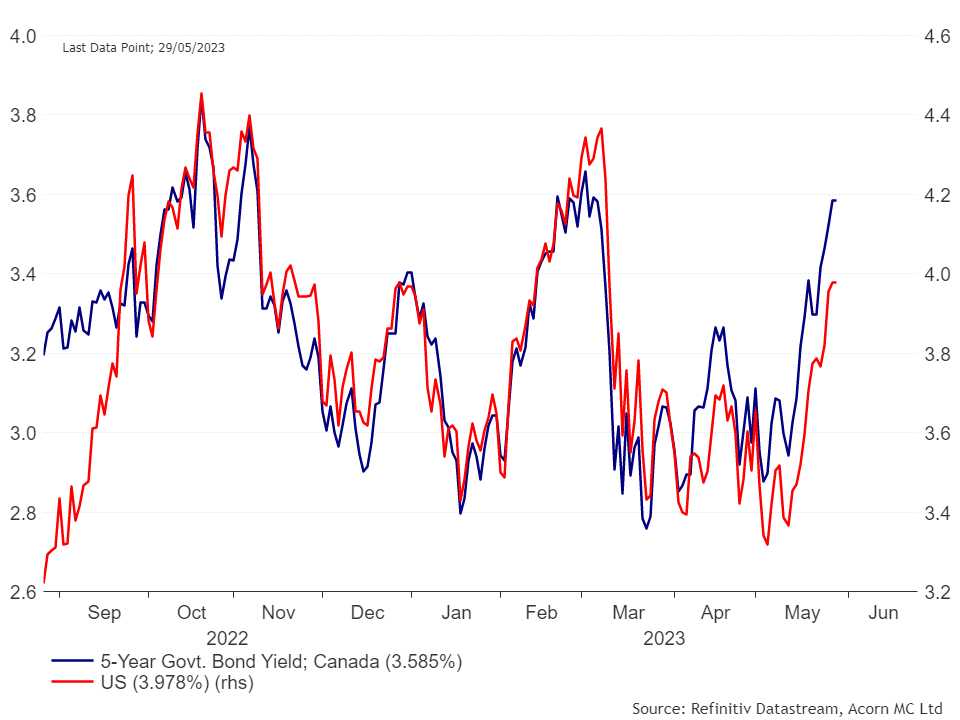

Canadian government bond yields have shot up on the back of the recent inflation print, which was stronger than expected. Additionally, market expectations suggest that the Bank of Canada (BOC) may not be done raising the main policy rate after all. Canada's yield curve (i.e. bonds at different maturity) is also highly influenced by the goings on in the American market.

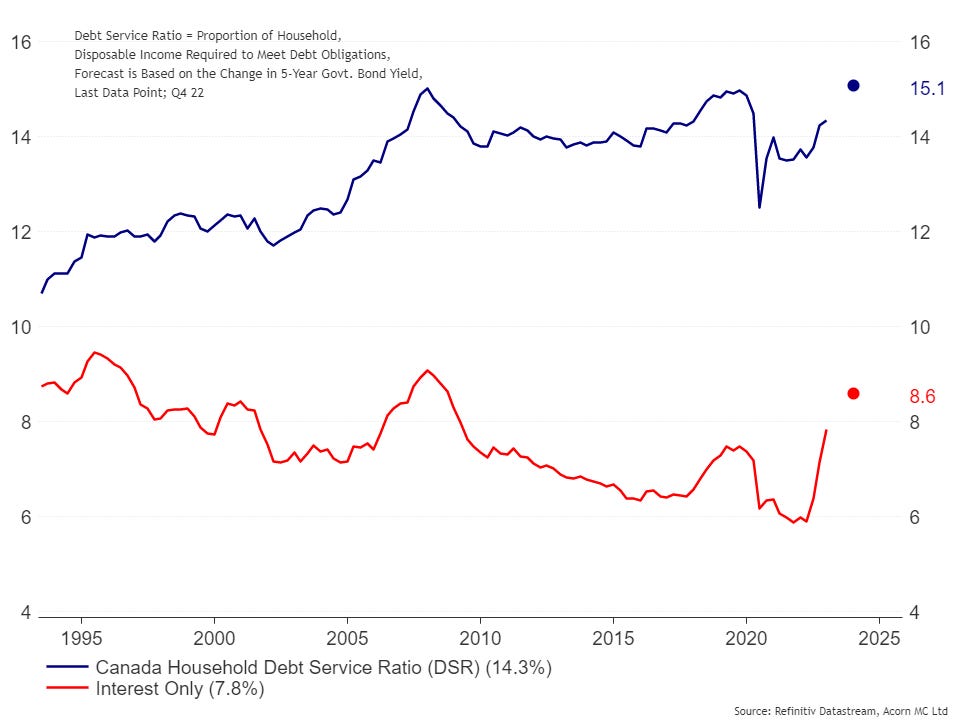

In Canada, debt service ratios (DSRs) are rising fast! More debt and higher mortgage debts are pushing DSRs to all-time highs. DSRs are significant in evaluating household finances as they offer insights into households' capacity to manage debt obligations and fulfil financial commitments. These ratios typically compare debt payments to income or other financial indicators, enabling an assessment of the sustainability of household debt. DSRs are critical in evaluating household financial health, affordability, creditworthiness, and overall economic stability. By analyzing the proportion of income allocated to debt payments, these ratios provide valuable information regarding the sustainability of household debt and assist in making informed financial decisions and shaping policies.

Persistent inflation, along with disruptions in Russian gas supplies due to the invasion of Ukraine, has led to Germany entering a recession in the first quarter of the year. The German economy contracted by 0.3% between January and March, following a 0.5% contraction in the previous quarter. Recession is defined as two consecutive quarters of economic decline. High inflation, which reached 7.2% in April, has hurt consumer spending and industrial orders. The German statistics agency, Destatis, cited the continued burden of high price increases as a key factor in the economic downturn.

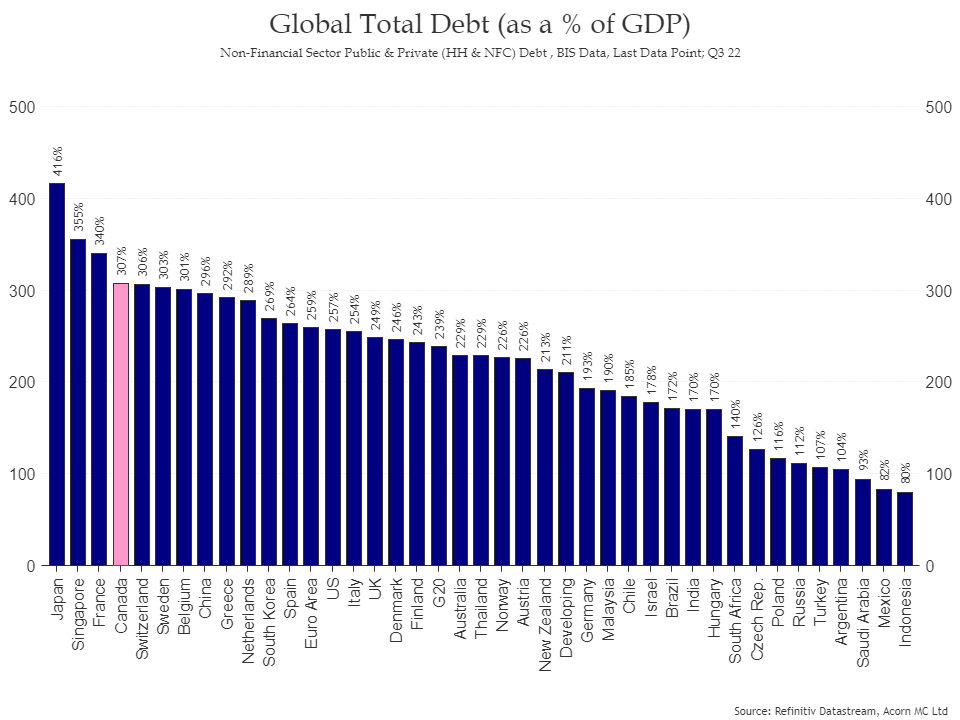

Total Debt-to-GDP ratio is commonly used as an indicator of a country's economic viability because it provides insight into the sustainability of its debt burden in relation to its overall economic output. While it is not the sole determinant of economic health, it offers valuable information for assessing a nation's fiscal position. Here are a few reasons why it is considered a useful measure:

Sustainability: Debt-to-GDP ratio helps evaluate a country's ability to service its debt obligations over time. If the ratio is high, it indicates that a significant portion of the country's economic output is being used to repay debts.

Comparative analysis: By examining how a country's ratio compares to those of its peers or historical data, analysts can identify potential risks and vulnerabilities.

Policy implications: Debt-to-GDP ratio influences policymaking and helps shape fiscal strategies. Governments need to consider the sustainability of their borrowing to ensure economic stability and avoid financial crises.

Investor confidence: Debt-to-GDP ratio is one of the indicators used by credit rating agencies and international investors to assess a country's creditworthiness.

Click below to listen to this week’s episode!