The Loonie Hour #86

On this week's podcast, we discuss internet censorship with Law Prof. Michael Geist, Canada's GDP growth, US jobs, the Fed and commodities pointing to recession.

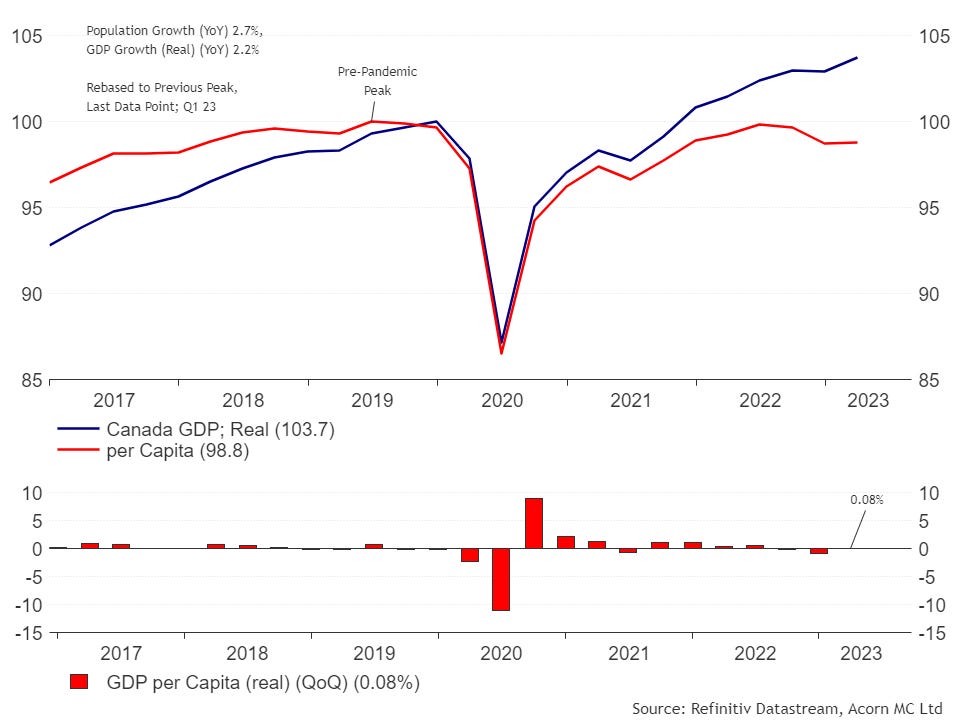

Canada's surging population growth - almost entirely due to a surge in immigrants and temporary residents - is propping up GDP growth but masking underlying economic weakness. However, it's important to note that strong population growth alone cannot sustain long-term economic prosperity.

A growing population leads to an increase in consumers, which can drive up demand for goods and services. This increased demand can create the appearance of economic growth and robust market activity, even if the overall productivity or efficiency of the economy is not improving significantly. For sustainable economic development, it is crucial to focus on improving productivity, fostering innovation, investing in education and skills development, and creating an enabling environment for businesses and entrepreneurship.

The only thing that matters is productivity growth or per capita GDP, and on this score, Canada has an awful record, with GDP per capita remaining below its pre-pandemic peak. In other words, Canadians are getting poorer.

Canada's stronger-than-expected economic growth may pose challenges for the Bank of Canada (BOC) in terms of maintaining credibility and achieving its monetary policy objectives, particularly in bringing inflation back to its target level. Population growth and diminishing disinflationary pressures could provide support to core inflation, leading to increased expectations of future interest rate hikes, as indicated by Forward OIS rates.

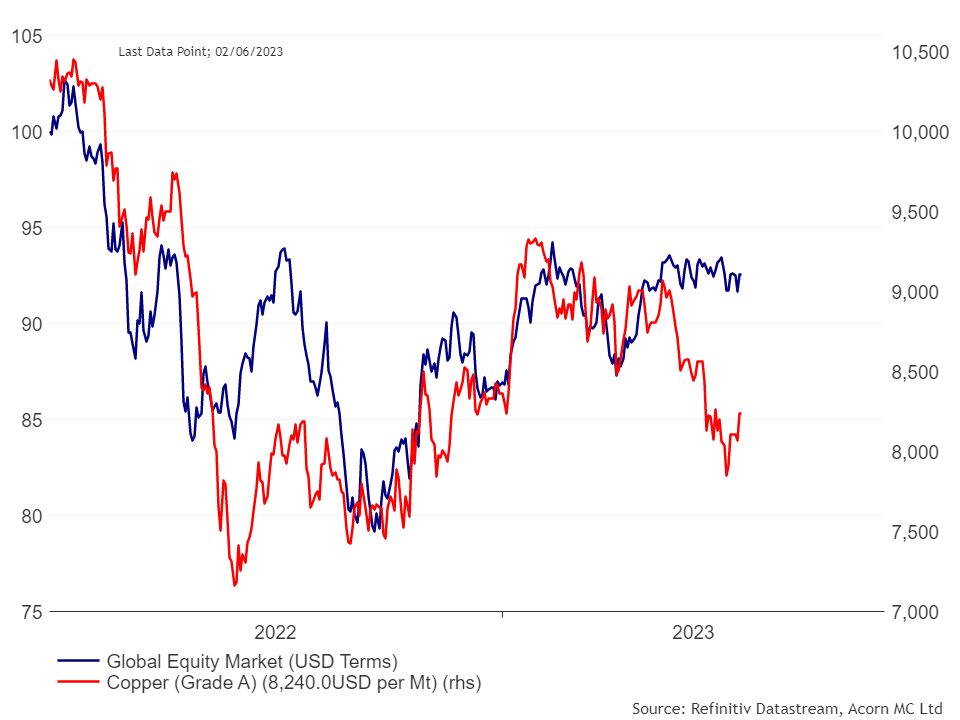

Copper, also known as "Dr. Copper," is often regarded as a reliable indicator or gauge of economic activity due to its extensive use across various industries. Its price movements are closely monitored as they can reflect market expectations, investor sentiment, and overall economic conditions. Copper prices are notably responsive to changes in supply and demand dynamics. However, it's important to acknowledge that other factors, including financial markets, monetary policy, geopolitical events, and commodity market dynamics, can also exert influence on copper prices.

In recent weeks, there has been an interesting divergence in the movements of copper prices and equity prices. While copper prices have experienced a decline, equity prices have remained stable and, in some cases, reached new highs, as seen in the United States. This discrepancy is noteworthy because both assets are highly sensitive to economic growth.

Click below to listen to this week’s episode!